According to blockchain investigator ZachXBT, Circle had been making money from transactions in line with the notorious North Korean hacking group Lazarus Group, a severe accusation lodged against the company.

The allegation comes after an incident in which Circle took more than four months to delay its blacklisting of funds associated with the group–more than a full duration longer than that taken by other major stablecoin issuers.

ZachXBT used social media to vent his resentment by drawing attention to Circle’s overall platform-wide failing in their fight against money laundering.

He said:

“Not once have you ever blacklisted after a DeFi exploit/hack when there was ample time, while you continue to profit off the transactions.”

The Lazarus Group Hack

The Lazarus Group was also seen as responsible for the recent hack of the Indonesian crypto exchange Indodax, which occurred on 11 September. This hack has resulted in the theft of over $20 million from this exchange, leaving it temporarily closed down to assess damage suffered.

Fuck Circle Fuck @jerallaire you do not care at all about the ecosystem except extracting from it.

Not once have you ever blacklisted after a DeFi exploit / hack when there was ample time while you continue to profit off the transactions.

You took 4.5 months longer than every… https://t.co/9TFn11UERU

— ZachXBT (@zachxbt) September 14, 2024

Once fully investigated, Indodax had opened itself up to further services, gradually resuming deposit and withdrawal services, as well as staking services.

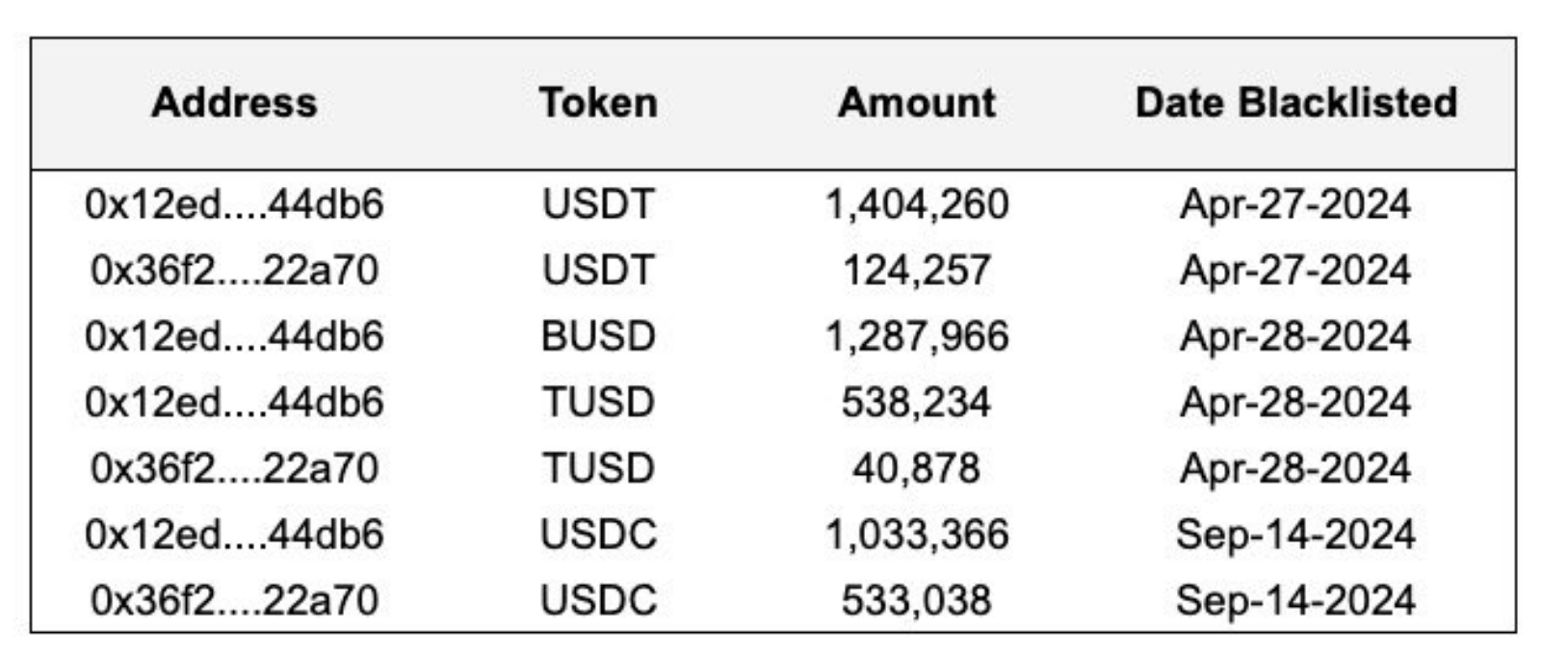

ZachXBT reported that four stablecoin issuers, including Tether, Circle, Paxos, and Techteryx, have blacklisted two addresses associated with the Lazarus Group, which hold a combined $4.96 million in various stablecoins.

Source: ZachXBT

Apart from the frozen blacklisted funds, the exchanges have already frozen another $1.65 million belonging to the hackers. So, this means that the total amount of frozen money now stands at about $6.98 million. Thus far, the ongoing probe shows a disturbing trend: the stablecoins are being utilized to launder the stolen funds.

There is evidence that Lazarus Group had managed to launder around $200 million from various crypto exploits into stablecoins including USDT and USDC between 2020 and 2023.

Circle’s Delayed Response

ZachXBT’s accusations have sparked a firestorm against Circle, particularly aimed at its CEO, Jeremy Allaire. The company’s critics are saying that Circle has hardly cared for the integrity of crypto ecosystem, and that profit seems to be taking up more space in the company’s lexicon.

“They pretend in public that it’s the compliant stablecoin meant to help protect the ecosystem but is in reality not exactly true,” ZachXBT commented. He noted that Circle, with a sizable staff, lacks an incident response team to handle DeFi hack or exploit-generated problems.

This criticism comes at a time when discussions about stablecoin regulation and anti-money laundering efforts are intensifying. The crypto space is growing even more worried about stablecoins when they connect with state-sponsored hacking outfits such as Lazarus.

The Bigger Picture

The Lazarus Group has allegedly stolen $3 billion from the digital currency industry in many high-profile attacks. These stolen funds may fuel the North Korea regime-backed hacking organization’s weapons development.

Featured image from Pexels, chart from TradingView