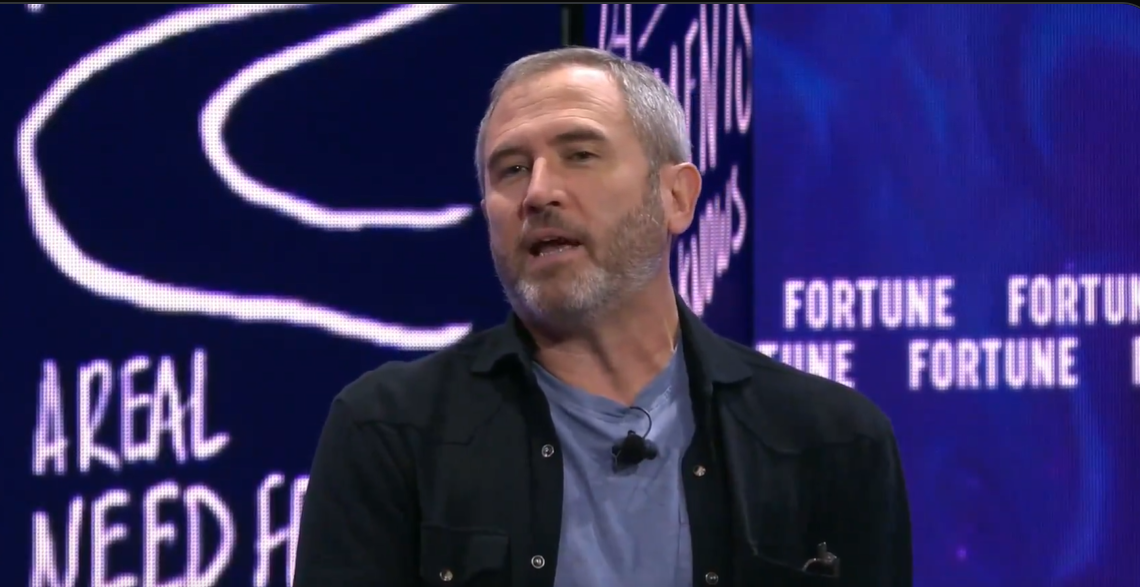

In an interview with Fortune’s Andrew Nusca, Ripple CEO Brad Garlinghouse provided an overview of the company’s strategic roadmap, their cautious approach to an initial public offering (IPO), and Ripple’s competitive edge over the traditional SWIFT network.

A Ripple IPO Currently Not On The Table

Garlinghouse was forthright about Ripple’s decision to hold off on an IPO amidst a challenging regulatory environment. He stated, “We have publicly said that we don’t have any imminent plans to try and go public. I mean why would you have in the current SEC. We’re not. I’m not very popular inside the walls of the SEC.”

This sentiment underscores the friction between Ripple and the regulatory body, notably after the landmark court ruling from July last year which determined that XRP is not a security. Instead of preparing for an IPO, Ripple pursued a different strategy which Garlinghouse made public during the interview.

“I’ve always viewed an IPO as a step in the journey, not the end of a journey. What we have done instead of and this is actually new news, that we haven’t shared publicly, we have done a series of tender offers where we’ve been buying shares back from investors and employees,” the Ripple CEO revealed and added, “now we’re in the middle of another tender offer and after we finish this we will have repurchased $4 billion dollar of stock from our shareholders.”

Ripple Vs. SWIFT

Garlinghouse also commented on the company’s competitive stance against SWIFT, the global standard for financial messaging and cross-border payments. He criticized the outdated nature of current wire transfer systems, noting, “The SWIFT Network, I imagine everyone here at some point in your lives has done a SWIFT Transfer, a SWIFT enabled transaction, you call a wire transfer.” He highlighted the historical context, “The expression wire transfers, the etymology of that is a telegram wire, right, it’s not technology that has moved with the internet.”

Garlinghouse championed the transformative approach of Ripple which can significantly reduce the friction involved in global money transfers, akin to advancements seen in digital communication. “Do we compete with SWIFT? Yes, there are a lot of payment networks out there and when I think about at the core what Ripple’s trying to do we’re trying to let value move the way information moves today,” he explained. By drawing an analogy to the evolution of email protocols that connected isolated platforms, he underscored Ripple’s goal to facilitate similar interoperability between diverse payment networks.

When Will The XRP Lawsuit End?

Garlinghouse also touched on the prolonged legal battle with the SEC over XRP’s status, which resulted in substantial legal costs but ultimately a favorable ruling for Ripple. “I always kind of looked at it’s a currency and we engaged in a three and a half year legal battle that culminated last summer. We won on the kind of core issue that XRP is not in and of itself a security,” he remarked. But the legal bill for this win was massive. “But it was $150 million of legal bills along the way,” Garlinghouse unveiled.

Speaking on the final remedies and penalty ruling, Garlinghouse expressed optimism for a soon to come resolution of the lawsuit. “There are a couple things that I’ll call cliffhangers that the judge should rule on imminently, you know a month maybe less, or maybe two months. I can’t know that, but I’m looking forward to a full resolution.”

At press time, XRP traded at $0.58336.